WeBull reminds us, that brokers are not your friend.

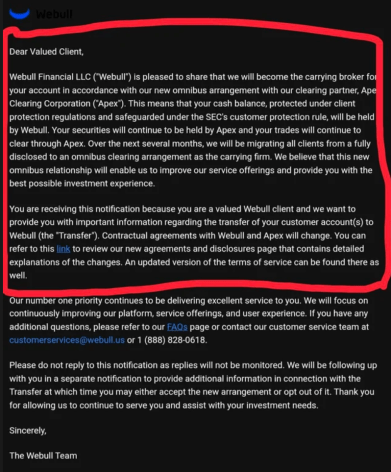

So WeBull, a brokerage, updated their services a few days ago as of 12/11/2022;

In it, WeBull has partnered with their Clearing, Apex, to put shares in an omnibus account.

Yea, if you know anything about omnibus or the DTCC net settlement systems, then you’ll know that your beneficially owned share is going into a pool of other beneficially owned shares. And you really don’t own your shares. That’s a key feature, not a bug -apparently-.

“We will be migrating all clients from a fully disclosed to an omnibus clearing arrangement as the carrying firm.”

An omnibus clearing arrangement is a financial agreement between a broker and a clearing firm that allows the broker to clear trades on behalf of its clients without having to disclose their identities to the clearing firm. Brokers do this by consolidating their clients’ trades and clear them through a single account with the clearing firm, without having to open individual accounts for each client.

Here is my shitty picture, the quality that you deserve;

the Clearing Houses’ side’s accounts registered by the Broker for their clients.

The ‘Before’ depiction is essentially a ‘Fully Disclosed arrangement’. Where a Broker discloses each account they manage with the clearing house.

Hence, the whole ‘omni-bus’ thing. Slap all them trades and funnel it through a single account. You get less transparency, which can be a good thing, but it comes at a cost.

Because it’s more opaque/less transparent, that means it’s harder for regulators or other market participants to track the trading activity of individual clients. Which can be a good or bad thing depending on who the regulator and market participant is. I mean, let’s be real, the regulators don’t do much, and market participants can fleece off your trade data.

With the added opaqueness, a Broker can fuck with their client’s accounts without reporting to the Clearinghouse. The Broker essentially becomes their own audit team and vet their reported trades to the Clearinghouse. Meaning that they can fuck around between their managed accounts without any of those trades ever hitting the Clearing House. Which also lets the Clearing House shirk liability and their own due diligence.

So this arrangement sort of bypasses some of the rules and protections and disclosures when the Clearing House isn’t held responsible for having to vet the numbers and do the indepth accounting merely because they have less available information/data.

-And I don’t mean that the Clearinghouse is some authority on this matter, because they’re not. They typically don’t snitch on their clients, unless their clients are riskings ‘systemic risks’. So, don’t get your hopes up thinking Clearing Houses are good guys either,

-They’re not.

Let’s be real, self regulated organizations (SROs) sure aren’t honest.

So this whole opaque and non-transparent thing, is definitely not all positive.

Oh wait,

Speaking of market participants fleecing off your trade data;

WeBull does use PFOF. You can thank SEC Rule 606 and 607 Disclosures about NMS and disclosures. So WeBull is profiting from exchanging trade data and literally capitalizing on it, so some other market participant can fleece off your trade data. Interesting.

Also this whole Omni-bus arrangement can facilitate short selling or lending. Without the identity of individual clients, market participants may be able to borrow or sell securities without being detected, which can increase the overall level of short selling or lending in the market.

That added risk of opaque obscurity providing smoke screen for shit-lending practices, and coupling that with PFOF means that lenders and other market participants can profit more from this.

Market Participants like

*Drum Roll*

WeBull themselves.

I am implying that a Brokerage could steal from their clients or mismanage their clients to result in clients losing money. It has happened before with other brokerages like RobingHood and eToro. Whether that has happened with WeBull, is a good question that any financial-yellow-journalist or investard should ask.

So PFOF is happening, and your trade data is getting sold. Chances are, your shares aren’t secured and they’re being lent or shorted against your own financial interests. Sounds like the very likely case scenario. I don’t personally blame WeBull for doing these practices, since this is an industry standard.

I think all these brokers suck, to be honest.

Yea, so much for a ‘valued Webull client’. I mean, you definitely are valued. You’re just not valued for being you, instead you’re the bag holder, and that’s a valuable position when you need someone left holding the bag. Calling you a ‘client’ is a formality, part of the show if you will.

In Closing,

This is just another reminder.

Just look through the category “Brokers aren’t your friends” on this article on this website. It’s a pretty important tag if you’re interested in better markets and market reform. You know, since money and finance are connected with livelihood and living. Seems like it’s pretty important, that thing we call a ‘human life’.

There’s plenty of evidence to remind you that;

Brokers aren’t your friends.

*Not Valid Financial, Legal, Life, or Any Advice.

Post Script,

So yea, Omni-bus arrangements sound powerful but they’re really lazy and kinda open things up to more problems through simplification.

Kind of like my discussion on Omni bus bills.

Using this whole OMNI thing, isn’t a good trend.

Unless you like, beat your son, or something;

[…] the books’ to rearrange when and where things are. It’s only made more easier with Omnibus arrangement accounts and the Continuous net settlement […]

[…] depending on how your shares are accounted for, your shares might be in some Omni-bus arrangement of shares. So it’s not technically yours being […]

[…] it turns out, with things like Omni-bus arrangement accounts and the Continuous-Net Settlement system, there’s a good chance that the shares you […]