Disclaimer:

I’m totally connecting dots that shouldn’t really be connected, and I am posing a question. Not a claim.

I’m retarded, don’t listen to me, this is just a crack-pot theory. (Unless true).

And there’s a great deal of evidence that shows eToro is doing something illegal, probably

I love talking about fraud, writing about fraud, and even watching fraud. It’s like there should be a Fraud porn. Anyways, smut aside,

I’m talking about this company:

eToro brought an interesting idea to the spotlight, whether they were the first or whatever, idgaf.

They paved the way for “copy trading” which is where degenerates copy the portfolio of other professional degenerates. So, some of these professionals bought GME, and so the copy traders would follow suit through their coding or magic-science robot, or whatever.

People could also opt out of ‘copy trading’ and stick to traditional YOLO 420 calls and yeet in to FD’s.

They also do some cryptos and other things that I wouldn’t know because I don’t use their service. And after today, I probably never will.

“Is eToro complicit in Securities Fraud?” is a question and we’ll dig in to the details.

There’s been some sketchy stuff and a lot of “fail to deliver” stocks. A lot of crazy things have happened in the stonk market around $GME. Some people seem very desperate.

There’s also a valid conspiracy that is backed by Governmental regulatory agencies.

So What did eToro did?

Well on February 1st, 2021, suddenly out of no-where eToro slapped a Stop loss on your stonks. Which means, if your stock drops below a specific value, it will sell at a loss.

This is to stop your losses, hence ‘stop loss’.

These stonks weren’t even bought on margin, so this is a definitely a new practice and it already sounds like Securities Fraud.

Like they can’t sell something on your behalf, if it’s 100% yours, and you didn’t tell them to. I’m not a securities lawyer but it sounds highly illegal.

You can opt out of the stop loss by paying an extra fee. Or at least, you could at one point.

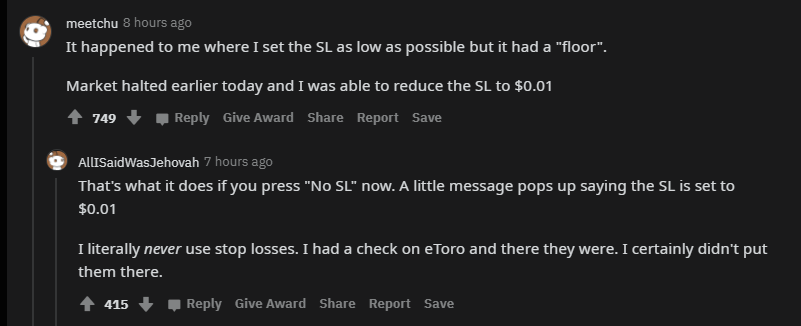

And then the application prevented you from even lowering the stop loss or removing it.

This picture is self explanitory:

Here is a video of someone literally trying to lower their stop loss:

What ended up happening, was that people were left holding a Stop Loss.

So people who bought the stock were essentially FORCED TO SELL AT A LOSS.

Yes, because if a company tells you when you can sell YOUR stock, it’s not really yours. Duh.

People took to other Socials to voice their opinion:

People have made Videos on Youtube about this thing, from Louise Rossman to Crypto Truth Angel, with sentiments on how this is mad sketch and possibly very criminal.

Twitter has plenty of fresh ideas:

eToro’s response:

Eventually the eToro Gents removed their forced Stop Loss, yet it’s too late.

People will remember how eToro did this, and they won’t forget:

Just to clarify, these comments were taken from their blogpost,

A lot of them are reasonably upsetti:

So what about Securities Fraud?

Hey, my second favorite word next to Regular Fraud. I’m getting there,

So the initial thing that added fuel to the GME craze was that GME was shorted about 139% (more so a short interest of 139%). Which means that if the price of GME was to go up enough, then eventually the shortsellers would have to buy the stock back, at a cost, and drive up their losses and the stock price. A perpetual cycle of them screwing themselves over.

Turns out, there’s not enough stocks for anyone to cover 139% of stocks, it’s -like- not possible.

So there is a theory going around that Retail investors have a lot of the shares and they aren’t selling. Which means that there might not be enough shares in the market to actually cover down. (I mean, there isn’t).

So the theory is that the hedge funds are lending and borrowing shares that may or may not exist.

Sounds like counterfeiting a security, or making fake stocks. You know, Securities fraud. Which I don’t care about personally, as long as they give retail investor’s either Fair Market Value (probably 10k a stonk) or the stonk itself.

Via the SEC document for fail to delivers, these are the Fail to deliver stonks as of January 14, 2021:

SETTLEMENT DATE|CUSIP|SYMBOL|QUANTITY (FAILS)|DESCRIPTION|PRICE

20210104|36467W109|GME|182269|GAMESTOP CORP (HLDG CO) CL A|18.84

20210105|36467W109|GME|490723|GAMESTOP CORP (HLDG CO) CL A|17.25

20210106|36467W109|GME|772112|GAMESTOP CORP (HLDG CO) CL A|17.37

20210107|36467W109|GME|799328|GAMESTOP CORP (HLDG CO) CL A|18.36

20210108|36467W109|GME|555658|GAMESTOP CORP (HLDG CO) CL A|18.08

20210111|36467W109|GME|703110|GAMESTOP CORP (HLDG CO) CL A|17.69

20210112|36467W109|GME|287730|GAMESTOP CORP (HLDG CO) CL A|19.94

20210113|36467W109|GME|662524|GAMESTOP CORP (HLDG CO) CL A|19.95

20210114|36467W109|GME|621483|GAMESTOP CORP (HLDG CO) CL A|31.40

The total amount of stonks failed to deliver per this report is a little more than 1, what that means is that there are some shares missing. Which means there are less shares to cough up for when the short sellers have to buy shares to cover their short positions.

Putting more of a squeeze on the short sellers.

Remember how GME was shorted like +130% for a while? Well that implies that the Short Sellers would have to fork up more stonks than there are in existence. Not only that, but they can only use the public float, which is a lot smaller than 100% of all GME stonks.

So the Market makers would have to create synthetic shares to cover their positions, but what if there is an egregious amount of shares missing?

I mean, about 600k shares were at one point missing.

There is also the idea that shortsellers create fake stonks as ammo to sell to drive the price down artificially, which is criminal.

So the conspiracy is:

“Did eToro have an involvement with Short Sellers to put force sell shares to put them back in the market?”

All of this should be investigated, because I’m not a securities lawyer and I’m probably wrong about several things. I mean, Which sock goes on which foot? Who knows.

But the paper trail and transaction history, followed by some confessions and testimonies will bring the whole thing out. Easy peazy.

It would just require some people to do their own Due Diligence and practice the law they supposedly learned.

Regardless of the conspiracy

It’s no doubt that shares were sold against customer’s wishes.

And the shares were sold in such a way during small volume, that the stock of GME fell.

Comparatively, 34 million volume is way less than the previous trading days.

So eToro is partially to blame for the devaluation of GME stock, which only matters if there is proof that a ‘short ladder’ attack occured. Which is market manipulation. If that is proved, then there could also be a case made against eToro with connections to the short ladder attack and fake-panic selling. Outside of the conspiratorial theory of them complicit in Securities Fraud, of course. (so two separate cases)

If you have diamond hands, and can study tea leaves, you probably know GME is bullish.

Side note:

This happened to some poor chap:

Recap of the possible things eToro can be responsible for:

- Selling your stocks for you, at a loss.

- Executing stop loss without consent

- Charging you fees, (having a ransom) for removing a stop loss position that you didn’t want

- Preventing you from removing a stop loss that you didn’t place

- Possible collusion with short sellers to put shares back in the market

- Possible Market Manipulation of driving the Specific stock down from Forced selling (at a loss mind you)

- Possible collusion with short sellers to Manipulate the market in a short ladder attack

- Also violating and exceeding Buy Limit orders

Yea, so eToro is definitely doing something. Probably illegal. I’ve named a few cases they can be involved in. Not to mention, like, the class action lawsuit and civil damages. Jeez.

Talk about suits fighting suits, amirite?

In Closing

You might also want to ask if Robinhood is complicit in this, because they raised Margin requirements without warning and margin called people. Meaning they sold other people’s stocks (at dirt cheap) without giving them even a notice that they were going to. Selling stocks at a loss or very undervalued to the average open and close price of the recent week.

If people had a notice of the raised requirements, they could at least PUT MORE MONEY in their account to prevent a Margin Call. Seem sketchy that Robinhood would Margin Call at no-notice. Also their actions of Friday the 29th were very sketch as well. Bearish signals on Robinhood.

Now back to eToro, why did they do this? Idk, but a lawsuit will require them to spit out the truth.

They could totally be illiquid and had to pull the strings on GME to not go under, because they might be involved in some sort of embezzling or money laundering scheme. But more likely they’re involved in traditional white-collar-crime securities fraud.

As a reminder, this is all speculation and tin-foil hat stuff, until it’s proven true, of course.

Long term Bearish signals on eToro.

To be honest, Long term bearish signals on most brokers for recent actions.

Cheers Degenerates,

*Not Valid Financial, Legal, Life, or Any Advice

[…] After market open on February 1st, GME took a plunge and there might be some connection with eToro force selling people’s stonks. […]

[…] eToro done goofed […]